Table of Content

- New Construction Homes In Peachtree City Ga

- Free Expert Advice From Top Construction Lenders

- MSHDA Board approves loans for rental development projects and lays groundwork for Housing and Community Development Fund

- Construction Loans and Modular Homes: All You Need to Know

- Modular Home Financing – What are My Options?

- GET A CONVENTIONAL CONSTRUCTION LOAN

- Modular Home & Construction

- Kit Homes: What You Should Know Before Buying

Again, we both appreciate all ofthe help from everyone at Pacific Manufactured Homes. We will definitely recommend them to anyone that is looking to buy a manufactured home. This means we offer a standard builder warranty on our homes for year one and then we work with a warranty company to provide a structural warranty for years 2 through 10. Finding a construction lender is as easy as typing new construction loan, into a google search. Be careful though, many home builders will attempt to lure you to their website and push you to buy or build a home through them, claiming that we can finance you. In reality, no residential home builder can get you a loan because they are not a bank.

The main disadvantage of modular homes is that they can be less aesthetically pleasing than custom-built homes. Before deciding whether to buy prefabricated or custom-built, you need to understand the different pros and cons of each. Lenders should have a decision for you within 24 hours after submitting your loan application. However, if youre borrowing more than $250,000, it could take up to five business days. Your lender will assess your credit history and income to determine the best loan option for your situation. If you own your own land and don’t owe anything on it, in many cases the bank will give you credit for the value of your land.

New Construction Homes In Peachtree City Ga

Professional sales manner and people skills are a credit to your organization. My sincere compliments to all of you in your performance and since the acquisition of my beautiful new manufactured home. Each step of construction and finishing was done with a professionalism rarely seen in today's world. Each person I've dealt with has treated me with respect and care, even when my concerns were unwarranted and even silly.

According to a Freddie Mac study, 20.2 percent of manufactured home loans were in default at the end of 2016. The US Department of Agriculture offers a type of modular home loan similar to the FHA loan called the USDA loan. This loan is meant for rural development and is guaranteed by USDA, which allows lenders to offer more favorable terms. Also, USDA loans do not have a down payment requirement and will loan up to 102% of the home’s value. USDA’s mission with its Rural Development program is to improve the quality of life in rural communities.

Free Expert Advice From Top Construction Lenders

However, it is important to understand that when you put less than 20% down on your loan, you will have to pay Private Mortgage Insurance . So if you have a $100,000 loan and the PMI is 1% per year, you will have to pay $1,000 per year on top of your normal loan payments, property taxes, and home insurance. Once you complete a contract to purchase a modular home from the builder you’re ready to apply for your mortgage. Once the application is complete, it will be presented to you, along with other documents and disclosures, for your signature.

After learning about these types of loans you will find it is easy to finance and build your dream modular home. FHA Loans are insured by the FHA and are the best choice for borrowers who don’t have a large down payment or less than perfect credit. If you have a higher debt to income ratio, we can help you find a lender that will assist you with financing.

MSHDA Board approves loans for rental development projects and lays groundwork for Housing and Community Development Fund

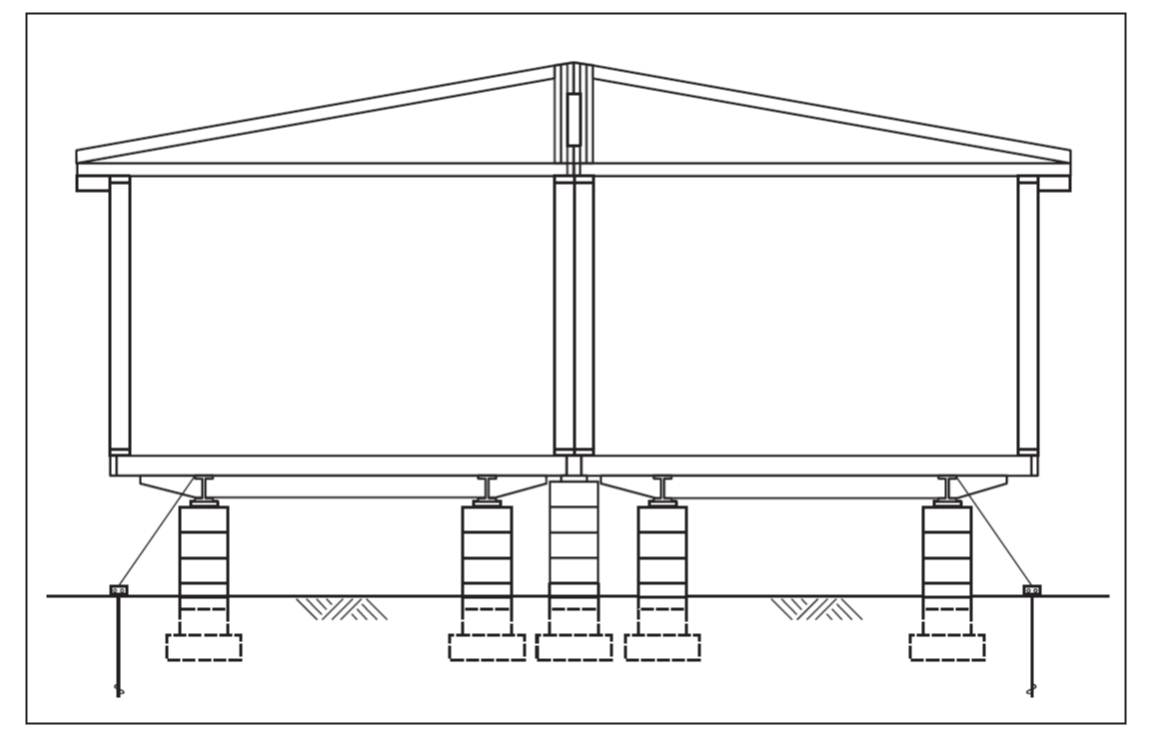

It’s much faster and can be more cost-effective than a traditional stick-built home. At the same time, the financing options are similar to traditional homes and you can get a standard mortgage. Modular houses are prefabricated homes transported module by module, usually in a semi-truck, to the property. There, the house will be assembled using a crane and placed on a permanent foundation. You’re likely not able to tell the difference between a modular home and a traditional house once constructed.

Finally, the proceeds of the construction loan are paid out in draws to the contractor/builder as the project progresses. The borrower usually pays interest-only payments on whatever draws the contractor or builder has taken. During the construction phase, periodic draw payments are made to contractors, subcontractors, and suppliers based upon work completed.

Construction Loans and Modular Homes: All You Need to Know

Therefore, they offer these loans for housing and community facilities. In order to qualify for a USDA modular home loan, the home must be located within the boundary area of a rural community as defined by USDA. If the bank has been able to satisfactorily answer their concerns about your mortgage, they will provide you with a formal commitment letter. This will state the specific amount of the loan that the bank will provide to you. This letter may include restrictions and conditions that you will need to honor before the loan can be closed and your home can start to be built. In addition, you will need to furnish a copy of the deed for your building lot.

Now that you and the bank have formally agreed to all the details and signed the formal loan documents, building of your modular home can commence. As detailed in the disbursement schedule, the payments will be made as each building milestone is reached and verified. This part is also the first time that you start making scheduled payments to the bank to cover the mortgage. You will only be making payments based on how much money has been disbursed, which means your payments will increase quickly.

Since these kinds of loans are secured by your homes value, interest rates are competitive, especially if you have good credit and enough equity for your lenders loan-to-value rules. The type of home youre looking for will affect the loans you may be eligible to receive. For example, if you want to buy a double-wide manufactured home that costs $100,000 or more, you wont be eligible for an FHA loan. In addition, older mobile homes may not qualify for financing at all.

There are many great government backed loan options available today. An FHA Construction Loan has a 3.5% minimum down payment requirement, and the VA and USDA Construction Loans have options for a ZERO down construction loan! Other than the down payment amounts, these loan options have basically the same underwriting requirements as a traditional loan. We have contacts with many lenders who are ready and willing to get you financed, so contact us today to get started on this modular home financing option.

This is usually the case if you have other strong compensating factors to help justify your ability to apply a higher percentage of your monthly income toward the housing payment. To qualify for FHA financing, your prefab home must have been built after June 15, 1976 and be permanently fixed to a foundation. If you’re buying a modular home that isn’t currently affixed to a foundation, don’t worry! Many lenders can structure a loan for you that will allow the foundation to be upgraded to FHA standards.

Disbursements, or “draws,” are made as predetermined milestones in the construction of your home are completed (i.e. pouring of the foundation). That said, a good builder will be helpful in referring you to a new construction lender. They should also be available and knowledgeable to answer any questions you have about the loan or the overall process. After construction is completed, an inspector will issue a certificate of occupancy that states that the home is complete. If you decide to use a lender to finance your new modular home, youll need a construction loan.

No comments:

Post a Comment